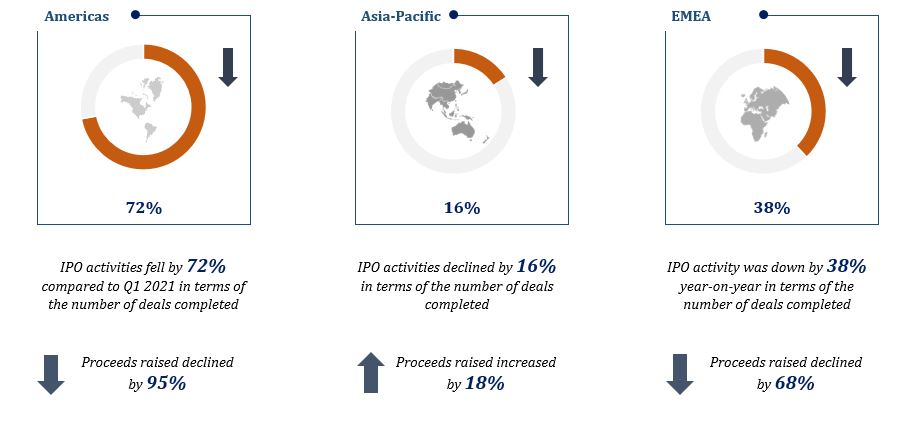

There was a significant decline in the number and value of IPOs globally in Q1 2022 compared to the same period last year. In the Americas region, IPO activity fell by 72% in terms of the number of deals completed, while proceeds raised declined by 95%. In the Asia-Pacific region, the number of IPOs declined by 16%, but proceeds actually rose by 18%. In EMEA, IPO activity was down 38% year-on-year in terms of the number of deals, while proceeds fell by 68%.

One of the key reasons for the decline in IPOs globally is the current valuation of companies. In general, companies are now valued at much higher levels than they were a year ago, making it more difficult for new businesses to list successfully. This is particularly apparent in the US, where the average IPO valuation has increased by 50% over the past year.

In Q1 2022, the number and values of IPOs globally has declined significantly compared to Q1 2021

Overall, the current market conditions are making it increasingly difficult for new businesses to list via an IPO. This is likely to continue to be the case in the short-term, as companies remain highly valued. However, in the longer term, if valuations start to fall back to more realistic levels, we could see a pick-up in IPO activity once again.

As the global economy slowly begins to rebound from the Covid-19 pandemic, many businesses are looking to go public and tap into the growing investor appetite for IPOs. However, in light of the recent market volatility and unprecedented challenges faced by businesses, it is more important than ever for companies to re-evaluate their business models and assess the risks involved in going public.

When valuing a company for an IPO, traditional financial metrics such as earnings and revenue growth may no longer be adequate in today’s market environment. Businesses must now account for macroeconomic factors such as inflation and interest rates, as well as the potential impact of geopolitical tensions on their industry. In addition, companies must be prepared to answer tough questions from investors about their customer acquisition strategies, business continuity plans, and how they will manage the transition to the post-pandemic world.

The good news is that there are still plenty of opportunities for strong companies to go public and achieve success in today’s market. By taking the time to thoroughly assess the risks and opportunities involved in an IPO, businesses can increase their chances of a successful debut on the public markets.

Our team of experienced IPO advisors analyses trends resulting from recent changes in the operational environment, & strives to continue monitoring. Contact us today to learn more. Looking to go public in 2022? You may set up a FREE consultation by emailing at john@kgfinadvisors.com